What are Business Cycles?

During last two centuries countries like USA and Great Britain have seen rapid growth but the economic growth has not followed a steady and smooth upward trend. From the long term perspectives it has seen a great upward trend in GNP (Gross Nation Product (GNP) of a country is the value of all finished goods and services produced by its citizens both domestically and internationally excluding the income earned by foreign residents) but within the upward trend there has been various short run fluctuations in different economic indicators. Period of high income, high employment rate, and higher output has been marked as the period of 'expansion' and period of low income, low output and low employment rate has been marked as the period of 'contraction'. The history of free market capitalist countries has shown that this period of expansion alternates with the period of contraction. These alternating periods of expansion and contraction in economic activity have been called 'Business Cycles' and since they occur periodically they are called cycles. The time period of each business cycle varies from a minimum of 2 years to a maximum of 10 to 12 years. The intensity of the swings of the economic indicators can also differ.

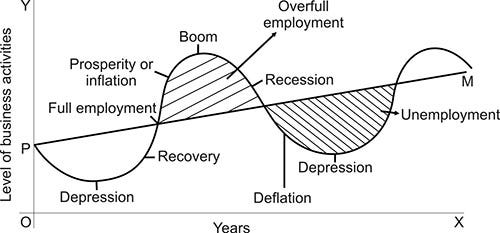

PHASES OF BUSINESS CYCLE

FIGURE 1

Business cycles have distinct phases and the study of these phases is useful to understand the economic indicators and activities in a particular country. However phases have been called by different names by different economists. Generally these phases can be distinguished as:

1. Expansion (Boom, Upswing or Prosperity)

2. Peak (upper turning point)

3. Contraction (Downswing, Recession or Depression)

4. Trough (lower turning point)

The four phases of business cycles has been depicted in the above figure where we begin with trough or depression i.e. basically when the level of economic activity in the country is in the lowest level. When economy starts reviving we enter the stage of expansion where all the economic indicators booms and starts expanding. However the expansion is not indefinite and there comes a point of peak where the economy reaches the highest level of prosperity. After that the economy starts losing its momentum and the economy starts depreciating and we enter the phase of contraction. The downswing continues till the lowest turning point called trough. However after remaining some time at trough the economy starts to revive and again a new cycle starts.

There are two patterns of cyclic changes. Figure 1 where fluctuations occur basically around the stable equilibrium point as shown by the horizontal line. The second pattern of cyclical movement depicts a change in economic activity that take place around growing path.

The phases of business cycle are mentioned below in a detailed manner:

1. Expansion and Prosperity-

This is a phase where both output and employment increases and production is at the highest possible level with the given resources. There is no involuntary unemployment (a situation when a person is unemployed despite being willing to work at prevailing wage rate) and whatever unemployment prevails is only of frictional (a form of unemployment depicting the gap between of someone voluntarily leaving one's job and finding another one) and other structural types. During this time a good amount of net investment occurs along with increased demand of durable consumer goods. Prices also generally rise during the expansion phase but due to high level of economic activity people enjoy higher standard of living. When everything is at the highest possible level this brings the peak of the business cycle in the economy. Then something might happen, like banks reducing credit flow in the economy or profit expectations change suddenly or businessmen become pessimistic about future state of economy that bring an end of this phase of expansion. However, economists differ regarding the possible causes of the end of prosperity phase. Monetarists argued that reduction of bank credit may cause downswing. Keynes have argued that sudden collapse of expected rate of profit (the concept of Marginal Efficiency of Capital) caused by changes in the expectations of entrepreneurs lowers investment in the economy.

2. Contraction and Depression -

As aforementioned, expansion or prosperity followed by contraction and downswing of the economy. During contraction not only GNP falls but level of employment also significantly gets contracted. Due to which involuntary unemployment appears on a large scale Aggregate demand falls for which there is excess supply in the market and prices starts reducing. With lower interest rate people’s demand for money holding increases and also net investment decreases significantly. Due to lack of demand there happen to be excess capacity within industries to produce capital and consumer goods. Thus depression and contraction is an utter state of economic downturn. The depression of 1929-33 is still remembered because of its great intensity which caused a lot of human sufferings.

3. Trough and revival -

There is limit to which contraction can happen. The point when contraction reaches its lowest level is generally called trough (which lasts for some time). After trough there comes the revival of the economy. The revival happens with various factors such as progress in technology (research and development sector), expansion of credit flow in the economy, optimistic expectations from the economy, increased net investment, external stimulus of investment etc. Thus the recovery or revival is the turning point from depression into expansion and then again the economy enters the state of prosperity. With this the cycle is complete.

Features of Business Cycles -

Though various business cycles differs in intensity and duration but they have some common features which are explained below-

1. Business cycles occur periodically and they do not show same regularity but they have some distinct phases called expansion, peak, contraction and tough. The duration is generally from 2 years to 10 years.

2. Business cycles are synchronic, that is they do not cause changes in single industry or sector but are of all embracing character.

3. Fluctuations does not only occur in level of production but also all other economic factors such as employment, consumption, investment etc.

4. Investment and consumption of durable goods such as house, car, refrigerator, television are affected most by this cyclical fluctuations.

5. Consumption of non-durable goods and services do not vary much.

6. Business cycles are international in character that is once started in one country they spread to other countries through trade relations between them. For example - depression of 1930s in USA and Great Britain engulfed the entire capital world.

7. In business cycles profits fluctuates more than any type of income.

8. The inventories of good starts increasing with the advent of contraction.